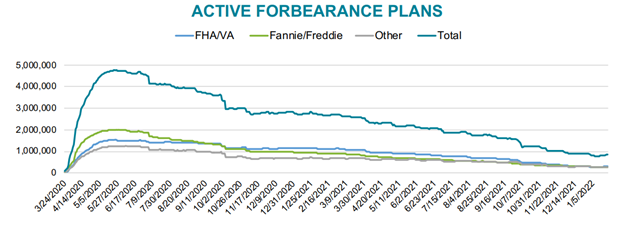

As we indicated in our August 9th, 2021 article, owners could still request COVID mortgage relief through September 30th, potentially extending forbearance until March 31st, 2022. In a recent article from DS News, the trend in active forbearance plans continues to decline, as show in this graph:

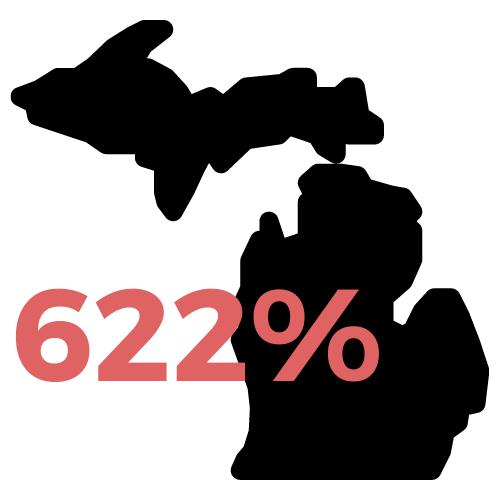

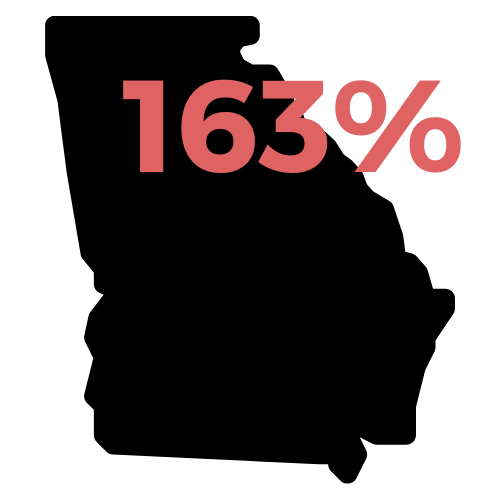

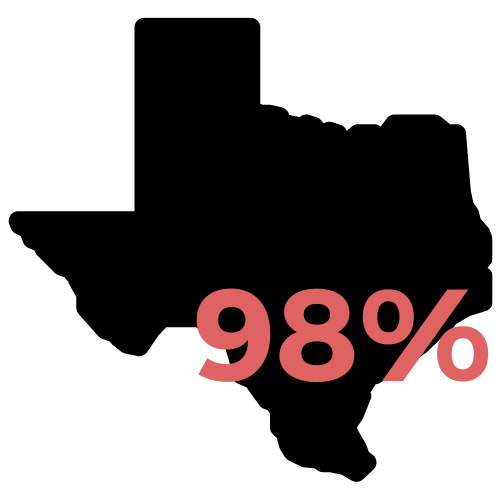

Attom Data shows a corresponding impact in foreclosures. In their January 2022 U.S. Foreclosure Market Report, default notices, scheduled auctions or bank repossessions were up 29% from a month ago and 139% from a year ago.

Repossessions by banks also increased, up 57% from last month and 235% from last year. These were the hardest hit states:

A recent article on Yahoo! Finance says it all: A Wave of Bankruptcies and Foreclosures Appears to be Building. Maybe. Maybe not. But, good managers will be prepared. Here are some steps to consider:

- Ensure your collection policy is being followed. Many communities slow-rolled collections during the pandemic, but now is the time to be vigilant and consistent.

- File liens to protect your interests if you are not in a state with statutory lien laws for condos & HOAs.

- Use a hardship verification service like the free tool at hardshipcalculator.com when hardship claims or payment terms are requested by a homeowner.

- Make sure your collector does a thorough risk analysis of all delinquencies to screen for bankruptcies, military activity, bank foreclosure, and lien priority.

- Require your collector to use current technology and predictive analytics to maximize ROI and reduce costly legal actions.

- Keep in mind that your collector or attorney are vendors and fiduciaries. You should circulate an RFP annually to ensure your community is getting the best value and performance when addressing delinquencies.

As we indicated back in August, we don’t yet know the extent to which delinquencies will increase, but they will increase. The astute Board and Manager will be prepared.