I have marveled at the way our economy has remained relatively healthy throughout COVID. Many of us expected a much more significant downturn, but some industries have actually prospered. Much of this can be attributed to the significant stimulus from the government, but that comes with strings attached. In this article we will take a look at what that stimulus means in the long run for community associations and how we can get ahead of the impact that will occur.

Do we have a false sense of security because of the trillions of dollars pumped into our economy? And if so, is that real economic health, or is it artificial? I contend that much of what we are experiencing is not sustainable, and we have a false sense of security, yet many want to believe that we will continue to experience economic growth. I call this artificial ignorance.

Artificial ignorance is not an antonym for artificial intelligence. It is merely a descriptor for the artificial sense of security we have during this once-in-a-lifetime pandemic. Some believe that our thriving economy will continue, but that is not plausible. What we have been doing is not sustainable. So, what comes next?

Who knows what will happen as we exit COVID, but I do know HOAs and condos are in a unique position. Unlike mortgage companies with federally backed loans, nonprofit community associations need timely payments to sustain their operations. These operations include municipal-like services and amenities, such as: trash collection, road and building maintenance, landscaping, snow removal, pools, fitness rooms, and playgrounds. The broad brush of forbearance and moratoriums cannot be applied to community associations, which operate as non-profits. Yet lawmakers continue to make overtures about relief for debtors that would leave community associations trying to survive without those payments. This could prove to be extremely harmful to our industry.

There are certainly situations where unique hardships related to COVID merit our consideration and support. Communities have been offering extended payment plans and withholding punitive collection actions in those cases. But, this can only be sustained to the extent that the rest of the homeowners within the Community can share the burden of those hardships. That is rarely possible, and the bank account is going to get dangerously low, so we won’t have an option but to require payment in order to fund the operation of the nonprofit community association.

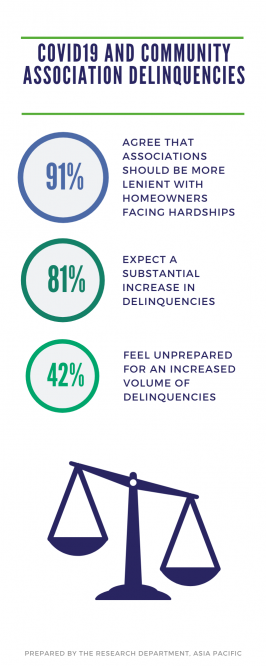

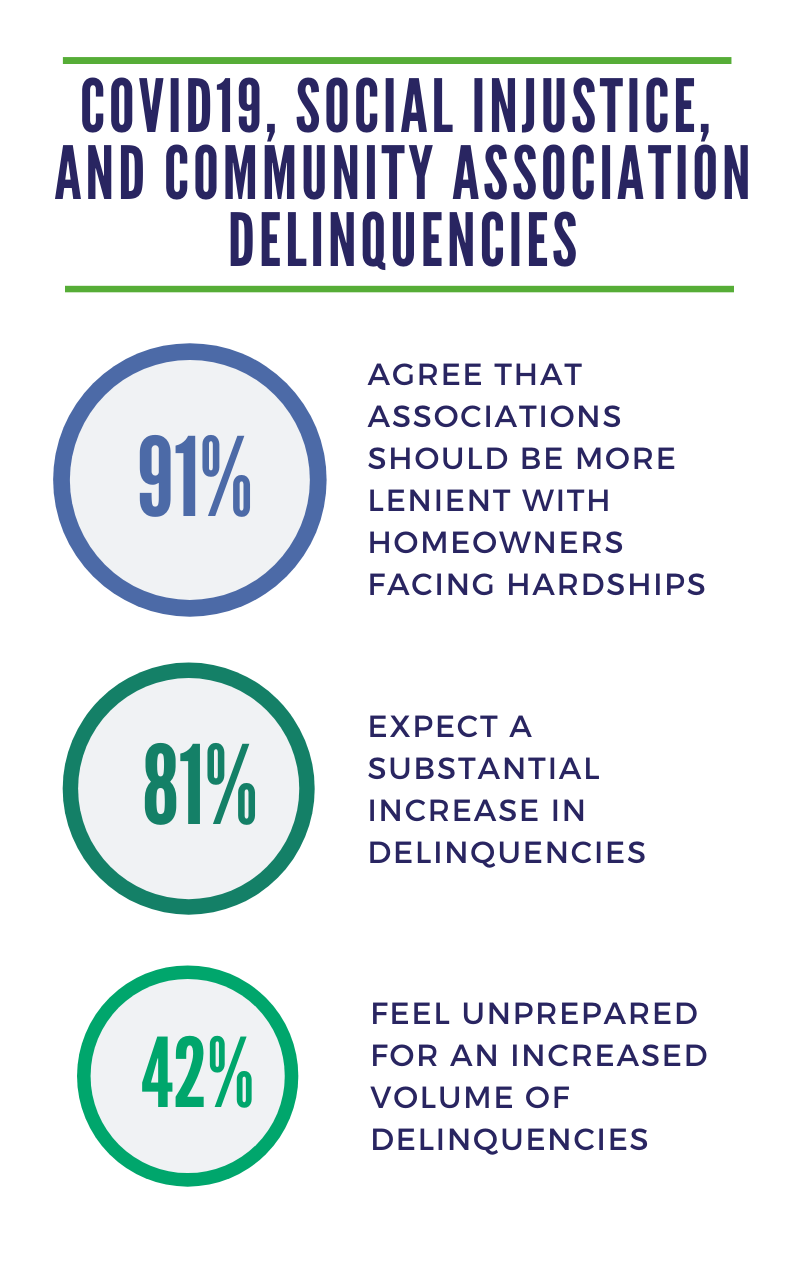

Community associations may be feeling good now, as a recent article published by the CAI found that delinquency rates for January and February were only 5%, a 2% decline from the end of 2020, but this cannot be expected to last long. As Dawn M. Bauman, CAE, executive director for the Foundation for Community Association Research and CAI’s senior vice president for government and public affairs stated, “While assessment payments are holding steady, we expect to see an uptick in delinquency rates once mortgage companies are authorized to handle delinquent mortgage payments.” Community associations need to be prepared for this increase, and this puts boards and community managers in a difficult spot. This can feel like a no-win proposition. But, it’s more important now than ever to collect on delinquent assessments before it gets too late and the financial problem spins out of control.

We need recognition of the unique challenges facing community associations. The broad brush that is being used by lawmakers and policy wonks is an existential threat to community associations if they are not acting with our unique situation in mind. Exemptions need to be extended to community associations, managers, and collectors for the work they are doing to help these nonprofits sustain their activities. Without some form of protection from government moratoriums and opportunistic attorneys, we all stand to lose.