ALERT: CAI Announcement & Six Ways to Vaccinate Your 2021 Budget

CAI just announced an extension of the Moratorium on Foreclosures through the end of the year. The CAI Board of Trustees also provided the following set of principles for community associations to adopt pertaining to homeowners who face challenges paying their assessments.

- If an owner is unable to pay assessments on time, the owner should notify their community association to work out a payment plan. Homeowners with a financial hardship should be encouraged to apply for government assistance, if available.

- Community associations should adopt a moratorium on foreclosures, in cases where the delinquencies are a result of COVID-19, until at least December 31, 2020.

- Community associations should consider waiving late fees and penalties for owners who face temporary financial hardships due to COVID-19.

- During the moratorium, community associations should only record liens or other legal complaints when failure to do so jeopardizes the association’s interest.

- Community associations should use compassionate language in communications with residents regarding COVID-19 delinquent assessments and clearly identify requisite legal notifications, disclosures, and/or disclaimers.

- Community associations should emphasize the importance of owners paying their assessments on time, if possible.

These principles make sense, but they put our industry in a tough spot. We are being asked to change the way we collect delinquencies amidst COVID-19, offering more leniency and holding off on liens and foreclosures. But our communities, which operate as non-profits, need those dues! Budgeting for 2021 will be a challenge.

Most economists agree that we are headed for a recession and a slow recovery. According to the Mortgage Bankers Association, the delinquency rate nearly doubled in the second quarter of 2020. During the Great Recession, mortgage delinquency rates were an important indicator of delinquencies for community associations.

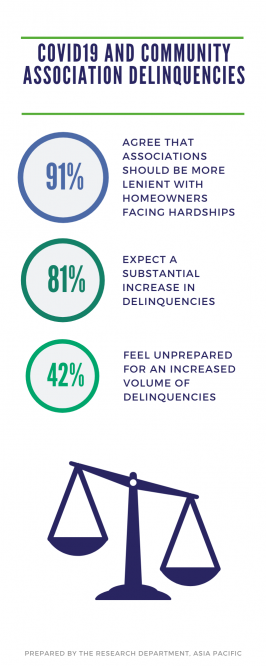

Equity Experts, which does collections nationally, identified a 12% increase in August delinquencies, and an alarming year-over-year increase of 38%. A recent survey of over 100 leaders in the community management industry found that a staggering 81% of participants said that they expect a substantial increase in delinquencies, and over 40% felt that they were unprepared to handle the increased workload.

Here are 6 ways to vaccinate your 2021 budget:

- Take a look at August delinquencies. The momentary absence of Fed unemployment, along with the subsequent reduction, is driving delinquencies. Expect that level to remain until unemployment benefits are adjusted or eliminated.

- Look for trends. How has your AR and collection expense changed in recent months? What happens if you extend that pattern into 2021?

- Revisit your budgets from 2009-2011. No one thought we would repeat the Great Recession, but pandemics don’t respect economic cycles.

- Make sure your financial statements show visibility and ROI into all collection costs:

- Time and total cost of recovery

- Bad debt line item for unrecovered legal/collection fees

- Bad debt line item for unpaid assessments

- Ask your collector or attorney to defer their fees. Communities struggling with unpaid assessments can’t afford to pay fees now in the hope that they are recovered in the future.

- Share the pain. If collection and legal costs are deemed unreasonable, or if they are reduced in order to get a settlement, ask your collector to absorb those costs.

According to TechCollect, a data and predictive analytics provider, the average cost assessed to a homeowner for a lawsuit or a foreclosure is around $2,500. Alternatively, their data shows that the average cost of collections without legal action is around $500. Up to 60% of owners will resolve their account without legal action if given an appropriate opportunity. Predictive analytics and data mining improve results by providing multiple communication methods for outreach along with a path to the shortest and least-punitive resolution.

Law firms that perform collections rarely have the resources or incentive to provide effective proactive efforts. And the collection policies proposed by many attorneys suggest prompt legal action after a single warning letter. This is troubling for Boards that want to adhere to the CAI principles and avoid costly legal action against their members.

Bottom line: We are headed toward a “new normal” for HOA delinquencies. Science and data can tell us where to invest our energy for the best results, and legal action will be increasingly rare. Besides, a compassionate, proactive approach, like the one detailed below, is just good business.

- Risk assessment prior to collection action

- Evaluate risk of bankruptcy, military activity, bank foreclosure, etc.

- Proactive outreach prior to legal action

- Phone, email, SMS and Social Media

- Debtor location methods for effective communication

- Address, emails, phone numbers, and digital footprint

- Payment plan options

- Utilize a Hardship Calculator to standardize payment plans

So, let’s count our COVID blessings: more settlement options and better recovery methods are a positive evolution for our industry. And the fiduciary obligation of Boards and managers is well-served by finding human-first solutions that reduce the need for legal action.