The past year has been difficult and uncertain for our country. A historical election, global pandemic, and a long-overdue reckoning on race are just a few of the life-changing events we’ve all been through. We are all navigating uncharted waters and doing our best to adapt. Amid this unprecedented challenge, racial tensions and inequities have come into focus that requires us to consider whether collection practices within our industry contribute to the problem or create a perception that might result in liability for boards and managers.

As we considered the impact of traditional collection practices, it became clear that these practices often disproportionately impact both the health and finances of certain minority populations. Being in an industry created to develop, maintain, and improve communities, we must recognize these inequities and make changes to the way we approach delinquent assessment collections. The traditional model of rapid legal action without any meaningful proactive outreach only adds to the unbalanced negative impact on certain groups who may already be suffering. That is why it is more important now than ever to initiate compassionate collections and provide homeowners with the proper education and means of communication to resolve their delinquent account prior to legal action.

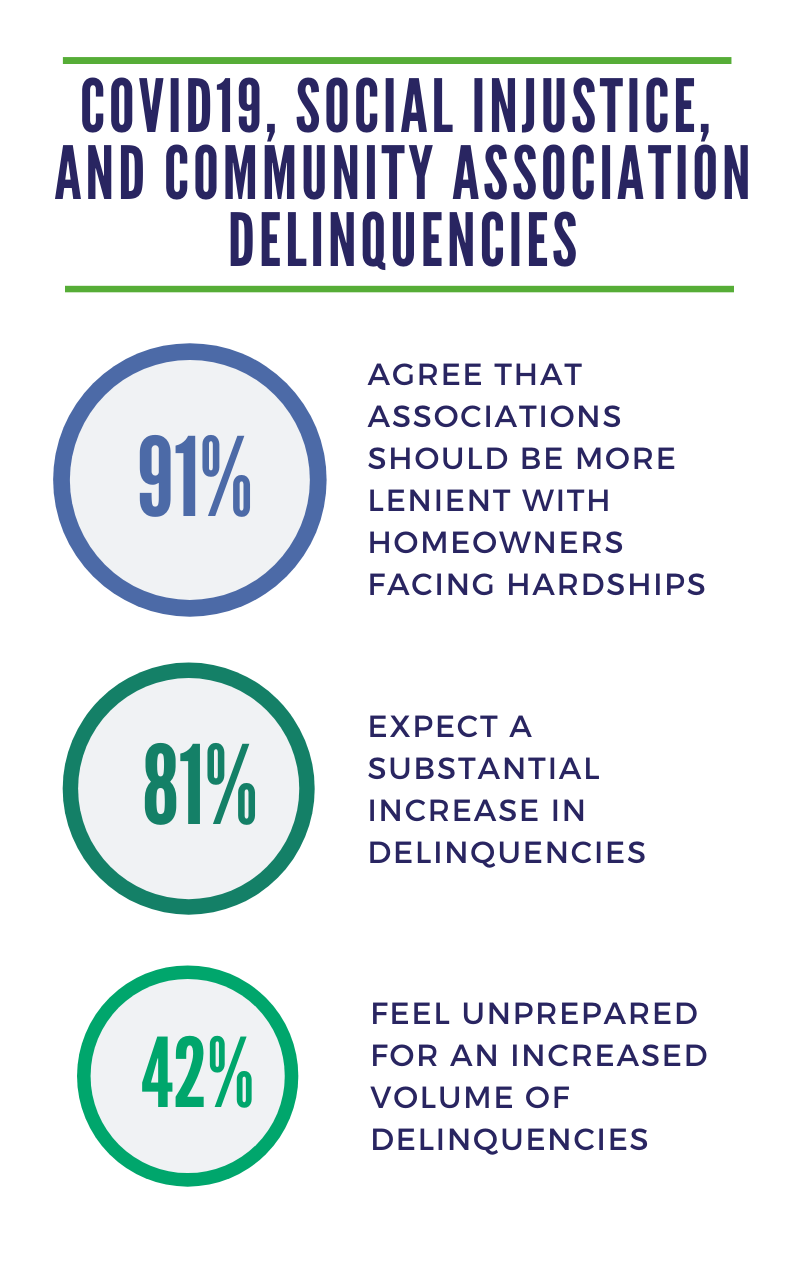

A recent survey from Equity Experts of over 100 presidents and leaders in the community management industry around the nation found that 91% agreed that, given the current social injustices and pandemic, community associations should be more lenient with delinquent homeowners who claim hardships. On top of that, a staggering 81% of participants said that they expect a substantial increase in delinquencies, but over 40% felt that they were unprepared to handle such an increased volume of delinquencies. Given this information, it is crucial to analyze the effects the current social and pandemic environment has on community associations and the solution to navigating through it and beyond.

Minorities hit harder in both health and finance

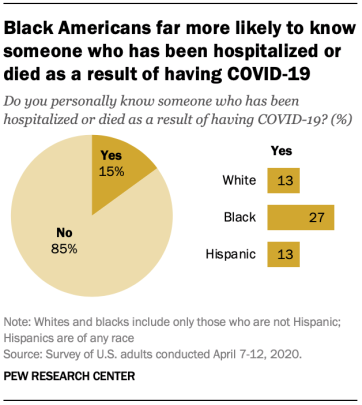

The health effects, both mental and physical, of COVID19 are far-reaching across all demographics, but it is clear that certain populations are affected significantly more. The following is from an April 2020 survey by the Pew Research Center.

“Among the public overall, 15% say they personally know someone who has been hospitalized or died as a result of having COVID-19. However, about a quarter of black adults (27%) say they personally know someone who has been hospitalized or died due to having the coronavirus. By comparison, about one-in-ten white (13%) and Hispanic (13%) adults say they know someone who has been so seriously affected by the virus.”

Additionally, APM Research Lab found that black Americans are 3.8 times more likely to die from the coronavirus than white Americans. As concerns mount in these communities about keeping themselves and their loved ones safe, it is understandable that many people may fall behind on their assessments while addressing their health and safety as a more urgent priority. As an industry, we should recognize this potential outcome and be prepared to address their delinquencies with the compassion and empathy they deserve.

To make matters worse, in addition to the virus affecting minorities to a greater degree from a healthcare standpoint, they are also more likely to be impacted by the financial repercussions of the COVID19 pandemic.

Unfortunately, the global financial impact of COVID19 will not be fully realized for quite some time, but it is already apparent how it has begun making an impact on our country. Despite the moratorium on foreclosures from the CARES act and other state–level relief bills, the loan delinquency rate is sharply rising in a way it has never done before. During the last recession, almost 10 years ago, it was proven that loan delinquency rates are an important leading indicator of delinquency rates in the community association industry, and leaders of our industry couldn’t agree more. From our recent survey, it was found that 81% agreed that delinquencies would increase, with many participants anticipating an increase of around 20%. As delinquencies begin to rise, we should be prepared to handle these in a better way for both those that fall behind and the community associations in which they live. From a May 21st article in USA Today:

“Mortgage delinquencies surged by 1.6 million in April, the largest single-month jump in history, according to a report from Black Knight, a mortgage technology and data provider. The data includes both homeowners past due on mortgage payments who aren’t in forbearance, along with those in forbearance plans and who didn’t make a mortgage payment in April.

At 6.45%, the national delinquency rate nearly doubled from 3.06% in March, the largest single-month increase recorded, and nearly three times the prior record for a single month during the height of the financial crisis in late 2008, Black Knight said.”

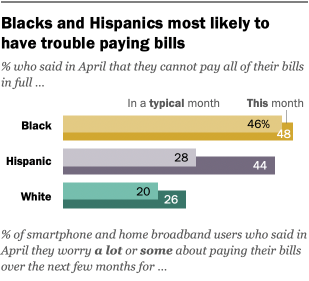

And while the financial impact of COVID19 will affect almost everyone in some way, the data also shows that minorities will feel the impact of these consequences at a much higher rate. Again, looking to a May 2020 study from Pew Research, they found that it is far more likely for Blacks and Hispanics to have trouble paying their bills due to the COVID19 Pandemic. In fact, nearly 50% of Black and Hispanic Americans believe that they will not be able to cover all or some of their bills during the pandemic.

Additionally, a large majority of those surveyed, (73% for blacks and 70% for Hispanics) indicated that they do not have reserves to cover their expenses for three months. Without the proper reserves to cover their expenses for three months, we are going to be looking at an increase in the number of accounts referred to collections, specifically for black and Hispanic Americans.

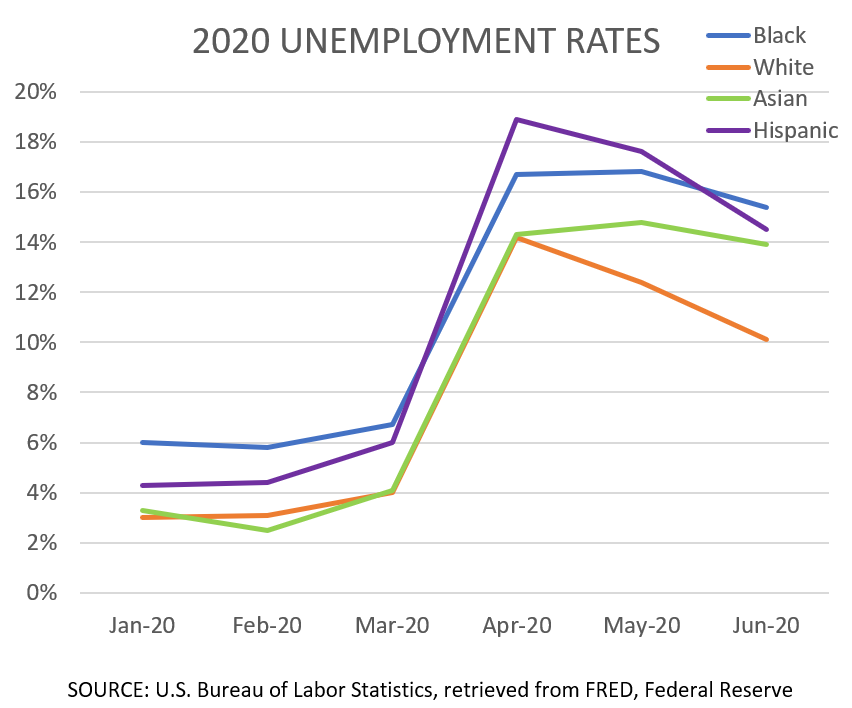

On top of that, unemployment rates have skyrocketed due to the Covid19 Pandemic. All races and ethnicities have suffered catastrophic job losses leading to financial burdens for everyone. However, the unemployment rate for white Americans is starting to decline at a much steeper pace than other minorities, specifically Black Americans, as displayed in the graph below. What this means is that it is very likely that minority members of our communities will struggle to pay their association assessments due to unemployment.

Negative Impact of Traditional Legal Driven Collection on Minorities

The collective data for these groups paints a potentially frightening picture. It shows that both Blacks and Hispanics are more likely to contract COVID19, and if they do get sick, they are more likely to be hospitalized or die. From a financial perspective, they are more likely to lose their job, and regardless of job loss, they are more likely to have a hard time paying their bills, including their association assessments. And if any or all of these things occur, they are the least prepared to deal with those types of acute financial emergencies because of their limited access to capital. All these facts make legal actions, where a large lump sum payment is often required to stop the process, an especially difficult and worrisome approach for these groups.

We know that our country is experiencing significant financial challenges due to the coronavirus, and that this virus is more likely to infect and kill certain racial groups. We now can see that those same racial groups will be impacted by those financial challenges at a much higher rate. Concurrent with these challenges, we also know that our country is in the midst of addressing social inequalities that very well may have created some financial inequities in the first place. What you may not know is that the traditional legal driven collection methods used by the community association industry makes these problems much worse.

Based on research from our data partner Techcollect, we found that the average cost to a homeowner for a lawsuit or a foreclosure is typically around $2,500. Alternatively, their data shows that the average cost of collections to a homeowner without legal action is around $500, and that up to 60% of delinquent owners will resolve their account without legal action if given an appropriate opportunity. An article from ProPublica found that most Americans who earn less than $60,000 per year have only $488 – $3,862 in liquid assets, and for black Americans that number is anywhere between 2x and 4x less given their income bracket. Using that information, it is clear that traditional legal methods of liens plus lawsuits or foreclosures will, for most Americans (certainly minorities) result in a situation where they do not have the money to pay for those costs.

It is extremely important for of all of us in the community association industry to recognize what the data is telling us and to address it head on. It is not a choice or an option to consider; it is a clear and unambiguous moral obligation.

The traditional legal driven collection approach taken by most of our industry, however well-intentioned it may be, has a disproportionately negative impact on certain groups and is a process that does not work particularly well for any group. The socioeconomic factors discussed above as well as potential language barriers for certain groups make legal actions especially difficult for these groups, often resulting in higher negative outcomes and increased financial burdens.

COMPASSIONATE COLLECTIONS

It may seem contradictory, but we are certainly not suggesting that certain racial groups should be treated differently. Community Associations, through their governing documents and day-to-day practices, are inherently focused on equal treatment and adhering to policies that ensure such treatment. So how can you address the present-day inequalities? Our solution is a more thoughtful and compassionate approach for EVERYONE. This compassionate, proactive, problem–solving approach can take many forms, but should include the following.

A custom proactive approach for reaching past due owners means not just sending a few letters, but should include phone calls, emails, and potentially even text messages or direct messaging through social platforms. The traditional and historical method of pursuing collections usually includes sending the homeowner a single letter to the address provided by the community, and then initiating legal action right away. In 2020, that is both an inefficient and ineffective way to approach delinquent assessments. Using our technology advancement through our partnership with Techcollect, we are now capable of determining the most effective ways to reach out to delinquent homeowners and to collect proactively and compassionately instead of forcing traditional, one-size-fits all methods that just flat out don’t work for everyone.

Utilizing a custom proactive approach means that finding the information on where to reach homeowners is absolutely essential. Some owners, such as landlords, do not live in their HOA, and regardless of that, snail mail is often ignored, lost, and thrown away. Therefore, the inclusion of debtor location methods is imperative to a proactive collections approach. Using established partnerships with reliable data vendors we are now able to find the best phone numbers, physical addresses, email addresses, and even social media accounts to reach delinquent owners.

Offering more comprehensive payment plan options is also vital to providing a more compassionate collections approach. This includes having bilingual agents who can discuss payment options, educating the owners, and guiding them to potential resources for financial aid and support. Community associations should have updated collections policies that provide these guidelines. However, you should also be sure that your collections partner is offering payment plans to your homeowners and empathetically educating them as well. Or, what if a homeowner is facing catastrophic financial difficulties? You should be sure that your collection partner is equipped to handle that empathically and effectively. That is why Equity Experts created RelEEf, to help homeowners get back on their feet.

Additionally, did you know that Equity Expert’s developed a free tool to help our industry evaluate debtors for payment plan consideration? The Hardship Calculator helps community associations make the best decision for their community, while providing financial assistance resources to homeowners. Tools like the hardship calculator help both managers and board members gather relevant information from the past due owner to determine the best payment options, while offering transparency and compassion.

MAKING CHANGES IN OUR COMMUNITIES

Using the above recovery methods well before considering legal options provides a more level playing field for members of all racial groups to become educated and knowledgeable about the debt that they owe and how they can address it. This approach also meets the fiduciary obligations of the community association board to refer past due files for collection in a timely manner while avoiding the potential liability of real or perceived discrimination.

Nobody likes collections, but it is a reality of our industry that cannot be ignored. It is our responsibility as community association leaders to have these conversations and move beyond the archaic collection methods that have traditionally dominated our industry. The standard, one-size-fits-all legal–driven approaches of the past have provided mixed results and can be especially difficult to manage for certain racial groups. Legal action is an important tool available to community associations, but it should be used only in the context of a comprehensive recovery plan that provides a more proactive approach with more options for resolution. Now is the time to collectively choose a more thoughtful and compassionate path that not only benefits community associations, but society as a whole.

At Equity Experts, we recognize our obligation as a trusted partner for community associations and their members. Collections is not only about financial outcomes, which is why our approach is focused on delivering unmatched results with both compassion and empathy. We understand the importance of legal action and often use legal methods as well. However, we ensure that through compassion and proactive outreach we try everything in our power to educate homeowners and help them pay their assessments before initiating legal action. Part of the way we do this is through our data software partner, Techcollect. Their unique solutions, including complex data driven collection modeling provides exclusive insights to better understand the best approach to reach owners prior to legal action, and for accounts where legal action is required, more predictable outcomes. We prioritize being part of the solution for a more just and improved world. Will you do the same?